30 Jul 2015

This blog was written by Andrew McGettigan and originally posted on Critical Education.

A new day, a new development for student loans.

Or rather confirmation of something that’s been in the pipeline for a while. I first warned in 2012 that clauses in student loan agreements would allow governments to change the terms for existing borrowers.

Up until the election, ministers were denying that any such change would be needed as the fee-loan regime inaugurated in 2012 was ‘robustly sustainable‘.

Now the government has published a consultation which in order to put English undergraduate financing on ‘a sustainable footing’ proposes as its ‘preferred option’ to go back to all those who have started since 2012 (and taken out loans) and demand that they repay more.

The proposed mechanism is that the repayment threshold of £21000 be frozen at that rate for 5 years after 2016. Borrowers were promised from 2010/11 onwards that the threshold would rise in line with average earnings after 2016.

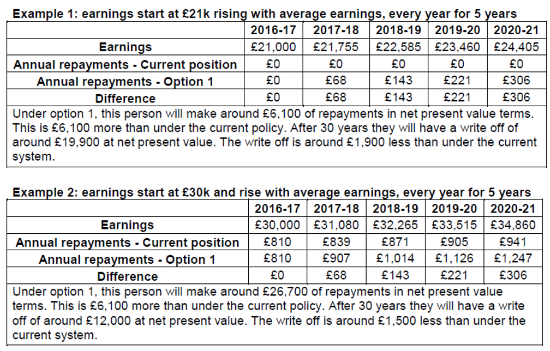

That change – ‘Option 1′ – will affect around 2million borrowers. A freeze for five years may not sound dramatic but if you expect a graduate starting salary of £30,000 or less the government provides examples to show that you will be £6000 worse off in net present value terms (using a discount rate of RPI plus 2.2%).

The very highest earners may actually benefit from this change as they will repay their loans more quickly.

The government estimates that this retrospective price hike will raise £3.2billion from the four cohorts who have experienced the £9000 fee (those who started between 2012/13 and 2015/16 inclusive). And their examples show it will be middle and lower earners who take the hit. This is consistent with the recent analysis published by Institute for Fiscal Studies.

The consultation closes on 14 October 2015. I urge you to respond as an individual if you are affected.

It’s fundamentally unfair to impose such changes after individuals have signed up for loans. The silence of the universities on this matter is worse than their craven behaviour in 2010. They don’t have any excuse now that the government’s own figures show the likely impact of what is proposed.

One other option is presented for consultation. This would see a five-year repayment threshold freeze introduced in 2020 for those starting after 2016/17. It would not involve a retrospective change in repayment terms.

Comments

Zainab 11 years ago

This is unfair to increase prices even more on students. I'm a final year student and was lucky to have support from parents to survive. Many haven't the option. If tuition fees increase many will opt out of further education. In terms of paying back loan repayments that are even higher than what the system provided in 2012 is also unfair.

Reply

Judith Joy 11 years ago

The entire system is grossly unfair and ensures that higher education can only be attained by the higher earning groups. As my 10 year old grandson said- 'Why do some people have everything and others nothing'.

Reply