Bring energy into public ownership

The history

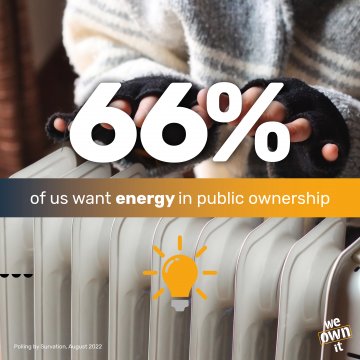

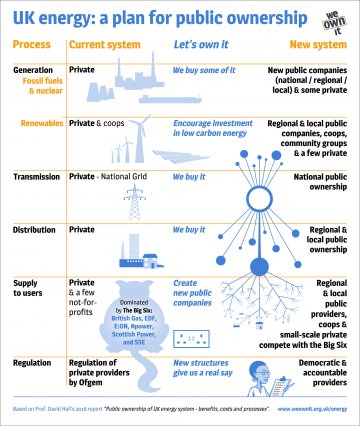

71% of us believe energy should be in public ownership, but our energy system is privatised at every stage: generation, transmission, distribution and supply.

Margaret Thatcher privatised our energy in 1986. British Gas was floated on the stock market, accompanied by the famous ‘Tell Sid’ advertising campaign which promised us we could still 'own it' through shares. In 1990, all of the UK’s regional electricity boards were privatised. Most households now get their electricity and gas from the Big Five energy companies (British Gas, Ovo, E.ON, Scottish Power, EDF). Energy is delivered by a privatised grid.

Privatisation was supposed to bring competition and lower prices. However, even before the energy crisis, the real cost of our bills had gone up, consumers were confused and for a country with our coastline, we were making slow progress on renewable energy.

Who owns our energy?

The UK won nature’s lottery with oil and gas in North Sea, and huge potential for wind and hydropower around the coastline. But we’re squandering it, allowing BP, Shell and co to take the profit.

Around 50% of UK offshore wind is publicly owned right now, but only 0.07% of it is publicly owned by the UK. Instead, publicly owned companies from Denmark and Norway take the opportunities and make the profit.

Once energy has been generated, it needs to be transmitted across the country. National Grid is responsible for gas transmission across the UK mainland and electricity transmission in England. You don’t have any choice about this as a consumer - it’s a private monopoly. In 2023, National Grid shareholders received £1.6 billion in dividends - money that could have been reinvested back into the system.

A handful of privatised distribution companies also take the energy - gas and electricity - from the power stations to your home. Shareholders from around the world profit from these monopolies. For example, if you’re in the North East, your electricity is delivered to your home by Northern Powergrid. This company is owned by American conglomerate Berkshire Hathaway, which is owned by US billionaire Warren Buffett. If you’re in London, the South East or the East of England, your electricity is delivered to you by UK Power Networks, which is owned by the CK Group. It has been criticised for paying its billionaire Hong Kong owner, Li Ka-shing, more than £2 billion in dividends since he bought the company in 2010. (Li Ka-shing's portfolio of UK companies also includes Northumbrian Water).

None of the Big Five retail companies (British Gas, Ovo, E.ON, Scottish Power, EDF) is itself a listed market company. All are subsidiaries of parent companies – four out of the five are listed on stock exchanges.

- EDF Energy UK is 100% owned by Électricité de France, a French public utility owned by the Government of France

- Scottish Power is 100% owned by Iberdrola (listed in Spain), a Spanish energy electric utility which counts BlackRock and the Qatari Investment Authority as its major shareholders

- In early 2019 Npower was bought by E.ON UK, making both subsidiaries of the German parent company E.ON SE (listed in Germany). Among the major shareholders of E.ON SE are RWE AG, another German energy company, Capital Group, a US asset manager, and the Canadian Pension Plan Investment Board, a Canadian Crown Corporation

- Ovo Energy is privately owned and SSE is now part of Ovo (the two major shareholders of SSE are giant US asset managers: BlackRock and Invesco)

- And finally the major shareholders of Centrica, the lesser-known parent company of British Gas, include the UK asset management firms Schroders and abrdn, as well as Bank of New York Mellon Corporation, a US investment bank

Shareholders around the world profit from our energy system and our outrageous bills.

We are delighted that Labour's plan to set up Great British Energy has been realised. The public want our energy system in public hands. Great British Energy, which would help tackle the climate crisis and lower bills, is the start of this.

Key facts

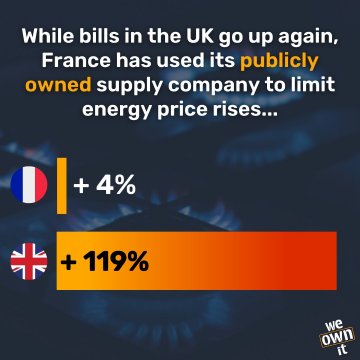

- In France, publicly owned EDF kept energy bill rises to 4% in April 2022 while our prices went up by 54% and will go up further

- UK energy bills in July-September 2023 will be more than 60% higher than in winter 2021/2

- The TUC has calculated it would only cost £2.85 billion to buy back the Big Five - a lot less than what the government spent propping up Bulb, a private company that collapsed in 2021.

- Research shows that prices are 20-30% lower in systems with public ownership

- In Norway, instead of allowing companies like BP and Shell to make huge profits, they have used their oil wealth to create a sovereign wealth fund which they are now using to pay 80% of people’s energy bills above a capped price. Germany, Italy and the US also have public suppliers

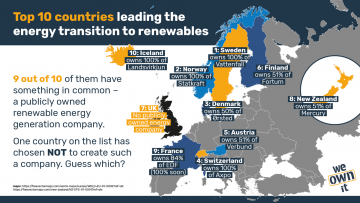

- 9 out of 10 countries which are leading on the green transition have a state owned company leading the way on renewables. (The UK is the only country which doesn’t.)

- The UK is the only country in Europe (apart from Portugal) which has a privatised electricity grid

- The current UK government has already decided to bring a part of National Grid into public ownership to lead the way on net zero - this involves legislation and compensation to shareholders, showing that it is all possible!

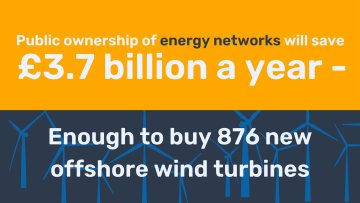

- Bringing the rest of the grid into public ownership would save us around £3.7 billion a year - buying it back would pay for itself in 7.5 years. £3.7 billion is enough to pay for around 222 wind turbines!

- In terms of buying back the energy grid - transmission and distribution - only 2% of it is owned by our pensions. 98% is owned by other investors around the world. For example, Northern Powergrid (distributor in the North East) is owned by US billionaire Warren Buffett while UK Power Networks (distributor in London) is owned by Hong Kong billionaire Li Ka Shing

- 66% of us want energy in public ownership

FAQs

What does it mean to bring energy into public ownership?

Our petition to nationalise energy suggests 5 ways energy could be brought into public ownership. We could start by

1) Nationalise the Big Five energy supply/retail companies

2) Introduce a permanent windfall tax on oil and gas companies like Shell and BP, at a rate of 56% (on top of corporation tax)

3) Set up a new state-owned renewable energy company to help tackle the climate crisis

4) Bring the privatised monopolies of the National Grid and regional distribution into public ownership

Should we nationalise the oil giants - BP, Shell and co?

Natural resources like oil and gas, wind, sun, hydropower belong to all of us if they belong to anyone. But BP and Shell are multinational companies and it would be very expensive and complicated to nationalise them. Instead we should tax them properly the way that Norway does.

The £5 billion windfall tax the government has already committed to doesn’t go anywhere near far enough. BP made record profits of £6.9 billion between April and June - the highest profits in 14 years. Shell made £9.5 billion in the same time period. These companies have also benefited from huge tax breaks.

It doesn’t have to be this way. Oil and gas companies operating in Norway pay a corporation tax of 22% AND a special tax of 56%. In other words, there is a permanent windfall tax. Norway first invested in developing its hydropower, so today 98% of the country’s energy is renewable. It then used its oil wealth to set up Statoil (now Equinor, 67% owned by the Norwegian state) and to create a sovereign wealth fund for the future worth $1.4 trillion.

Like Norway, the UK should introduce a permanent windfall tax on oil and gas companies like Shell and BP, at a rate of 56% (on top of corporation tax). Norway is paying 80% of people’s bills above a capped price. We should use the revenues to cut people’s bills, invest in renewable energy and pay for further nationalisation policies that will benefit the country.

The energy crisis is caused by increased wholesale prices because of Russia etc. Ownership makes no difference?

It’s true that this is a global crisis. But privatisation isn’t helping. In many other countries - like France and Norway - energy bills haven't gone up the way they have here. Their governments are using public ownership as a tool to help people.

Even before the current energy crisis began, domestic energy bills steadily increased in “real” (ie inflation-adjusted) terms by 50% from 1996 to 2018. In 2013, the Office of Fair Trading aptly described the oligopoly of the big energy companies as a “confusopoly” - deliberate complex price structures. Smaller retailers were running losses to get market share.

Right now privatisation means we

- Waste money on shareholder profits

- Fail to invest enough in connecting renewable energy to the grid

- Miss opportunities to drive forward the green transition, both in terms of new renewable energy and insulating housing

Public ownership could mean

- More stability in the retail market not chaos

- Saving money on shareholder dividends

- Planning ahead and investing more in renewables

Should we nationalise the Big Five energy retail companies?

We should start by turning any future retail companies that fold into a public supplier, as we argued when Bulb collapsed. These new companies could keep bills low, plan for fluctuations in global energy prices and investing in renewable energy. The market is in chaos - 40 energy supply companies have gone bust recently, affecting nearly 6 million customers.

British Gas, EDF Energy, E.ON Next, OVO and ScottishPower are the five biggest suppliers in the country. The TUC says it would cost around £2.85 billion to bring them into public ownership. This is comparatively little given that the government is said to have spent £6.5 billion propping up Bulb. The TUC points out that the new publicly owned company or companies could deliver a programme of efficiency retrofitting to upgrade homes as well as making bills fairer.

Wouldn’t it cost too much to bring energy into public ownership?

It would cost very little to set up a new state owned renewable generation company. In Germany, France and Italy most people already get their energy from a publicly owned company.

TUC analysis suggests taking the Big Five retail companies, with over 70% of household customers, into public ownership would cost around £2.85 billion. Again, much less than the government paid to prop up Bulb (£6.5 billion) The National Audit Office also estimated that energy customers will need to pay £2.7 billion to cover the costs of the energy suppliers that have failed since June 2021 and this was before Bulb.

Buying back the energy grid - transmission and distribution - could cost around £27.9 billion. It would save us around £3.7 billion a year so it’s a policy that would pay for itself in just over seven years.

What about our pensions?

Britain’s main pension funds own less than 0.2% of Shell and BP shares.

In terms of buying back the energy grid - transmission and distribution - only 2% of it is owned by UK pensions. 98% is owned by other investors around the world. For example, Northern Powergrid is owned by US billionaire Warren Buffett while UK Power Networks is owned by Hong Kong billionaire Li Ka Shing. Of course we need to protect UK pensions but the best way of doing that isn’t to compensate shareholders around the world at full market value.

See the info above (who owns our energy) on the Big Five - they are almost entirely listed in other countries/nothing to do with our pensions.

How do we wean ourselves off gas as quickly as possible?

The UK should set up a publicly owned renewable generation company to reduce our dependence on fossil fuels like gas, and move us faster towards renewable power like wind and water. 9 out of 10 of the countries leading on green energy have one (the UK is the only country which doesn't).

A publicly owned renewable energy company would work locally, regionally and nationally to deliver a just transition. It would skill up workers, provide decent UK jobs and level up communities. Profits can be returned to the public purse here in the UK instead of flowing out of the country.

The Norwegian state owns Statkraft, the largest renewables generator in Europe (which operates in the UK). Norway is considering setting up a state-owned hydrogen company. Meanwhile Denmark owns 50% of Ørsted (previously DONG Energy) which is the world’s largest developer of offshore wind power.

Research shows that state owned utilities invest more in renewables, and their investment also encourages private sector investment. 9 out of 10 of the countries leading the green transition have a state owned renewable energy generation company - why are we choosing to do things differently?

Evidence from the MIT Center for Energy and Environmental Policy Research shows "a consistent pattern concerning the role of ownership on renewable energy investment among European utilities: state-owned utilities dedicate higher shares of investments to renewables, particularly in countries with stringent climate policies and when the general quality of regulation is high".

Research from Mariana Mazzucato shows that "public investments not only have a positive but also consistently the largest effect on private investment flows relative to feed-in tariffs, taxes and renewable portfolio standards in general".

The French government has said it wants to take full control of EDF again to put it in a better position to make looming investments and move faster on big projects.

Hasn’t the government already brought National Grid into public ownership?

The UK government is pushing ahead with plans to create a new public body to oversee Britain’s energy system as it continues to transition away from fossil fuels, effectively renationalising critical responsibilities that have been held by National Grid since its privatisation in the 1990s. They are planning to create a publicly owned “future system operator” by 2024 which would take on the main responsibilities for managing Britain’s electricity system currently carried out by National Grid, plus some of its work in overseeing the gas network. This system architect/planning role is needed in the public sector to get us to net zero.

Some of National Grid’s powers and responsibilities are being handed to this new publicly owned body. (National Grid will continue to own and maintain electricity and gas pipes and wires in Britain and has in recent years been developing a number of subsea cables to trade power with the rest of Europe.)

As part of the arrangements, the UK Treasury will have to compensate National Grid shareholders for the transfer of some of its powers, although a financial settlement has yet to be confirmed. Legislation and compensation arrangements are all happening, under a Conservative government, because it’s seen as necessary. Where there's a will there's a way!

I support Ecotricity/Good Energy. Why do you want to nationalise them?

We don’t. It would be sensible to set up a new public supplier in the market to take on the customers of all other failing suppliers. It would also make a lot of sense to nationalise the Big Five. But other smaller suppliers could remain.

Robin Hood Energy and Bristol Energy failed - that shows public ownership doesn’t work?

It’s a question of scale. Bulb had 1.7 million customers - taking over an operation at that scale would have meant the government could easily compete with the Big Five.

Robin Hood Energy, however, only had 112,000 residential customers. People are slow to switch energy provider but if companies are collapsing and the government can provide a decent deal for people instead, that’s much easier than building a startup from scratch and enticing people to switch. As mentioned above, other countries have publicly owned energy companies that work well.

The government is bad at running things - why do you want them running energy?

Professionals need to run public services, with input from users and workers. But these professionally run organisations should be owned by us all and working for our benefit. Of course ultimate responsibility for public services lies with the government - that’s democracy - but day to day decisions should be made by those who understand the industry and can provide a good service for all of us. Most other countries already understand this.

Do you support Just Stop Oil?

Yes. We need to move away from fossil fuels and gas as soon as we possibly can. The whole world - including Norway - needs to stop drilling and switch to renewable energy to tackle climate crisis. While we're allowing private oil and gas companies to operate in any way, we should be taxing them at the same level as Norway, and using this money to invest in the clean, green, affordable energy of the future.

Does We Own It support the Don’t Pay campaign?

We’re really happy that this campaign exists to force this issue up the political agenda. People are absolutely desperate and they’re taking action. We hope the Don’t Pay campaign forces the government to consider policies like public ownership that could make a material difference to people’s energy bills and set us up well as a country for the future. The cost of living crisis and the climate crisis are both very real - we need urgent and serious solutions.

Photo used under Creative Commons licensing, thanks to stevep2008 https://www.flickr.com/photos/stevepj2009/