17 Nov 2025

In its 10-year plan for the NHS the government has indicated its readiness to use private finance for infrastructure development.

In this open letter to the Chancellor, Rachel Reeves, 53 academics of accounting and finance from several UK universities explain why she should abandon the idea of new private finance for the NHS.

Dear Rt. Hon. Rachel Reeves,

In the UK Infrastructure strategy and in the 10 Year Plan for Health, the government proposes to explore the renewed use of private capital for funding the building of NHS facilities, specifically Neighbourhood Health Centres.

We, the undersigned academics, write to you today to ask that you abandon this dangerous and damaging proposal and fund public services through direct taxation or borrowing, or a mix of both.

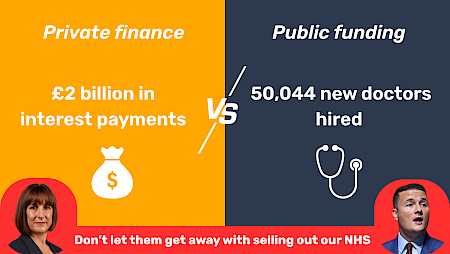

Combined, 80 NHS trusts are still set to pay out £44 billion toward PFI contracts signed between 1999 and 2018. These payments will come out of their already under-resourced budgets. Given higher private borrowing rates, NHS trusts are effectively being forced to pay out sums they could otherwise put toward patient care.

Using private capital to build new healthcare facilities does not bring “new money” into the NHS. PFIs are simply a roundabout way to borrow money expensively, which current and future generations of taxpayers will be required to pay back. In practice, this means that the NHS has to pay huge charges to PFI consortia before a penny is spent on anything else.

The argument that PFIs are a “necessary evil” and the only way of procuring much needed finance for the NHS is completely bogus. Private finance deals should no longer be used as an off-balance sheet way to borrow to invest. They should count toward public borrowing, and so, in addition to being a wasteful approach to the public finances, they also exacerbate the fiscal “black hole”. In short, they increase government debt and are poor value for money.

The Office of Budget Responsibility indicated in 2017 that using “off-balance sheet” financing for public infrastructure to dodge borrowing rules amounts to a ‘fiscal illusion’ and that it should only be used if there is a clear value for money justification.

And as the National Audit Office stated in 2017, even after more than two decades, ‘there is still a lack of data available on the benefits of private finance procurement’. Moreover, according to a 2011 Treasury Committee report, PFI hospitals are 70% more expensive than the publicly financed option.

More specifically, analysis suggests that the use of private finance for small-scale projects represented even worse value for taxpayers than its use for bigger projects. Neighbourhood Health Centres, the projects for which you are proposing to use them now, are likely to be closer in character and scale to those small-scale projects than to the big hospitals.

There have been suggestions that the government is considering using Wales’ private finance model, called the Mutual Investment Model (MIM), for building Neighbourhood Health Centres. This model sees the public put up a small portion of the initial investment. The vast majority of the capital investment is still privately borrowed, and the lion’s share of the profits goes to the private sector.

Welsh Labour Member of the Senedd for North Wales, Carolyn Thomas, has said that Wales’ private finance model “is more expensive [than direct public investment] in the long run – with higher repayments that ultimately cost taxpayers more for the same infrastructure.” She has also written to you in September, calling MIM “sub-optimal” and damaging to the public purse in the long term. And she is right.

This or any other model of private finance in public services should not be adopted in England.

Using private capital in the NHS is no different from a family buying their home using a payday loan. We are asking you to learn from the mistakes of the past. We ask you to please drop any plans for new private finance in the NHS from the Autumn Budget and any future policy.

Thank you very much for your time.

Yours sincerely,

-

Lord Sikka - House of Lords Emeritus Professor

-

Professor Christine Cooper - Chair in Accounting, University of Edinburgh Business School

-

Professor Rania Kamla - Chair of Accounting, University of Edinburgh Business School

-

Dr Claudine Grisard - Lecturer in Accounting, Queen Mary University of London

-

Dr Omiros Georgiou - Associate Professor in Accounting, University of Birmingham

-

Trevor Hopper - Emeritus Professor of Management Accounting, University of Sussex

-

Dr James Brackley - Lecturer in Accounting, University of Glasgow

-

Theresa Hammond – Professor of Accounting, San Francisco State University

-

Professor Stewart Smyth - Professor of Accounting for Sustainable Business, Cork University Business School

-

Bridget Fowler - Emeritus Professor of Sociology, University of Glasgow

-

Dr Sara Closs-Davies - Senior Lecturer in Accounting and Tax, University of Manchester

-

Professor Anne Stafford - Professor of Accounting and Finance, University of Manchester

-

Dr Soon Yong Ang - Lecturer in Accounting, University of Stirling

-

Dr Anwar Halari - Senior Lecturer in Accounting, The Open University

-

Professor Teerooven Soobaroyen - Professor of Accounting, Aston University.

-

Dr Jonathan Tweedie - Lecturer in Accounting, University of Manchester

-

Dr Susan O’Leary - Senior Lecturer, Royal Holloway, University of London

-

Dr Xia Shu - Lecturer in Accounting, Cardiff University

-

Dr Giorgos Gouzoulis - Associate Professor of Management, Queen Mary University of London

-

Professor Alpa Dhanani - Professor of Accounting, Cardiff University

-

Professor Mike Danson - Professor Emeritus of Enterprise Policy, Heriot-Watt University

-

Professor Shahzad Uddin - Professor of Accounting, University of Essex

-

Professor Hugh Willmott - Professor of Management, Bayes Business School and Cardiff Business School

-

Dr Christos Begkos - Associate Professor in Management Accounting, University of Manchester

-

Dr Michele Bigoni - Reader in Accounting, University of Kent

-

Dr David Yates - Senior Lecturer in Accounting, University of Sheffield

-

Dr Shuo Wang - Lecturer in Financial Accounting, University of Edinburgh

-

Professor Chandana Alawattage - Professor of Accounting, University of Glasgow.

-

Professor Helen Tregidga - Professor of Accounting, Royal Holloway, University of London.

-

Dr Anne Steinhoff - Lecturer in Accounting, University of Essex

-

Professor Ataur Belal - Chair in Accounting and Sustainability, Birmingham Business School, The University of Birmingham

-

Professor Hendrik Vollmer - Head of the Accounting Group, Warwick Business School

-

Professor Rob Bryer - Emeritus Professor of Accounting, Warwick Business School

-

Professor Gerard Hanlon - Professor of Organizational Sociology, School of Business and Management, Queen Mary University of London

-

Dr Elisavet Mantzari - Associate Professor in Accounting, University of Birmingham

-

Dr Ann-Christine Frandsen - Reader in Accounting, University of Birmingham

-

Professor Kathryn Haynes - Emerita Professor of Accounting, Northumbria University

-

Dr Yinuo Pan - Lecturer in Accounting, University of Strathclyde

-

Professor Crawford Spence - Professor of Accounting, King’s College London

-

Dr. Mayya Konovalova - Lecturer in Accounting and Taxation, University of Birmingham

-

Professor Jim Haslam - Professor of Accounting, Durham University

-

Dr Gabriela Rozenfeld - Assistant Professor in Accounting, University of Birmingham

-

Dr Eleanor McNally - Senior Lecturer in Accounting, University of Bristol

-

Dr Helen Mercer - independent PFI researcher

-

Professor Afshin Mehrpouya - University of Edinburgh

-

Professor Chris Land - School of Management, Anglia Ruskin University

-

Dr Eleni Chatzivgeri - Lecturer in Accounting, University of Edinburgh Business School

-

Professor Lisa Evans - Professor of Accounting, Stirling Business School, University of Stirling

-

Dr Salman Ahmad - Lecturer in (Management) Accounting, Aston University, Birmingham.

-

Professor Martin Quinn - Professor of Management Accounting & Accounting History, Queen’s University Belfast.

-

Dr Lesley Catchpowle - recently retired Senior Lecturer in Economics, Accounting & Finance, University of Greenwich

-

Professor Shamima Haque - Professor of Accounting, University of Dundee

-

Dr Tom Haines-Doran - West Yorkshire Policy Fellow, Leeds University Business School

Say NO to Private Finance in the NHS

Rachel Reeves will be making a final decision about new NHS private finance at the Autumn Budget on the 26th November.

We'll be handing in this petition to the Department of Health and Social Care on Tuesday 18th November.

We're also sending MPs our briefing on NHS private finance, which outlines the different ways in which PFI has been repackaged, and the impact this has had on taxpayers and patients.

Email your MP: make sure they have the whole story on NHS private finance

Comments

Malcolm Hunter 3 months ago

Private finance is an astronomically expensive way of funding public capital investment, which would hang a further millstone around the neck of the NHS (which is already still burdened by the ongoing cost of past PFI). The public sector can borrow for capital investment more cheaply than the private sector, and direct public investment would avoid vast sums of public money being siphoned off into private profits and the NHS being tied in to continuing to pay for things that are no longer needed, when circumstances change.

Reply