1 August 2024

Thames Water is the UK’s largest water company, serving 25% of the population. And it’s about to go bust.

Two credit agencies have labelled its debt as "junk”. Its shareholders have written down over half its shares to zero: they’re now worthless. Thames has enough cash to last until May but OFWAT has given it until September to turn itself around.

How did Thames get here? Shareholders heaped on £16 billion in debts to pay themselves dividends. Bill payers now see 28 pence in the pound go to servicing those debts.

So what needs to happen next? Here are the 6 steps the government must take to protect households and our rivers and seas.

1. Take control of the crisis: put Thames into a Special Administration Regime.

Under this power, the Environment Secretary can take control of Thames Water away from shareholders and creditors, preventing them from doing any more damage.

A government appointed administrator runs the business, to ensure bill payers still get their water, until it can stand on its own feet again, likely under a new owner.

2. Prioritise protecting people and waterways, not shareholders.

Special Administration always has a purpose: either to rescue the business with its current shareholders or transfer to a new competent owner.

Labour must ensure the shareholders who made this crisis don’t see another penny of public money. In short, we must not rescue the business for shareholders, but transfer into public ownership so people and planet come before profit.

3. Cut the debt to protect the public — make the creditors take a hair-cut

Special Administration gives the government the power to prevent or limit Thames Water’s £16 billion debts coming onto our books — to be paid by the tax payer — if it protects the public interest.

According to legal advice seen by the Financial Times there is “no reason” for the public to take on their debts in the case of nationalisation. How would this work in practice?

The creditors of Thames Water can be required by the special administrator, with the permission of the High Court, to take a hair-cut, with debt effectively being wiped of their value.

Don't believe us? Here's what the Treasury and JPMorgan, the world's biggest bank had to say.

Plans from the Treasury, code named Project Timber, would see some bondholders take a hair-cut seeing 40% of debt wiped off. JPMorgan, who were advising creditors, suggested that a hair-cut of up to 55% could take place.

With two credit agencies, Moody’s and S&P, writing down Thames bonds to “junk” level, there is an argument that creditors could face even large hair-cuts, reducing the debt to almost nothing.

Right now if you are a Thames Water customer, the company bosses are spending 28 pence of every pound you give them on their debt servicing costs. With Special Administration, the public could see nearly a third as much investment in infrastructure, without a single bill hike.

4. Refuse to compensate profiteering shareholders.

If Thames is to come into public hands, does the public have to pay shareholders compensation? And if so, how much?

Shareholders have already written the value of their stakes down to zero and Special Administration lets the government prioritise the public interest over compensation.

Nationalisation plans drawn up by the Treasury would see shareholders “wiped out,” with no compensation, a step further than New Labour who used Special Administration to cut compensation to Railtrack shareholders by 75% when it went bust in 2001, saving the public billions in 2002.

This means that taking Thames Water back into public ownership would cost MUCH less than privatisation's defenders would lead you to believe.

5. Transfer Thames to new owners: local bill payers.

Having created a new company unburdened by Thames Water’s debt and agreed that no (or very little) compensation will go to shareholders, who will take it over?

In most countries, local authorities, such as devolved regions or local councils, own water on behalf of their constituents. For the UK, this could help avoid water becoming a political football in Whitehall.

A new ownership structure to include each local council served by Thames Water should be created. A model for this approach is Lothian Buses in Edinburgh which is owned by a coalition of four councils.

6. Put the public and our rivers and seas at the heart of decision-making.

When Thames comes out of Special Administration, the crisis may be over but the hard work will only just be beginning.

We can’t return to unaccountable and opaque management of something so fundamental as our water.

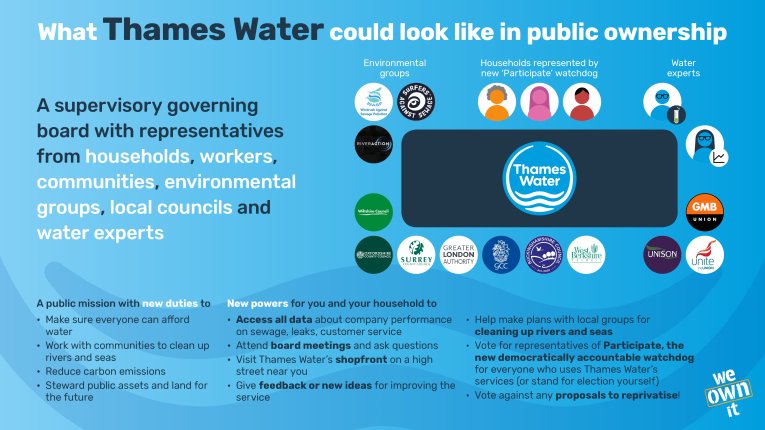

We propose putting control in the hands of a supervisory governing board with representatives from households, workers, communities, environmental groups, local councils and water experts. Similar models are used in Spain, France, and beyond.

Read more about the plans in our blog: what could Thames Water look like in public ownership?

Comments

Patrick Lefevre replied on Permalink

Always was a disgrace to allow our natural resources fall into the hands of scanvenger speculators, they should never have been allowed to sell land etc

Keith Walkling replied on Permalink

Water is the source of all life. It's too important to be left in the hands of individuals and organisations who's only interest is in shareholder value.

NADY D GHALI replied on Permalink

Thames Water is bust. Its shareholders need to accept that they have lost their money. Most, if not all, of its debt financiers need to do the same thing. They took the risk of losing their money. They have done so. That's how markets work, unless you are a pro-market extremist, of course, when the idea that the market might fail cannot be tolerated.

It is only because we have pro-market extremists in charge of this country that we are debating whether the debts of Thames Water should be repaid or not. It should be obvious to anyone with the slightest sense that doing so is impossible. What we should be doing now is working out how to deliver clean water, rivers and beaches. Instead, our politicians are obsessing about how to save financiers who were stupid with their funds from embarrassment. You cannot get a clearer indication of the failed priorities of all those at the top of our political system than that.

Cathy m replied on Permalink

Despite evidence stacked against their highly destructive Abingdon Reservoir plans, Thames Water continue to push for more investment for this. This is a prime example of profits over people and the environment.

Please also support a call for a public inquiry.https://you.38degrees.org.uk/petitions/stop-thames-water-s-plans-for-a-devastating-mega-reservoir

Sandra peake replied on Permalink

It was not yours to sell off it’s ours the peoples

Stop this madness

Add new comment