16 May 2017

It's fantastic that the Labour party has committed to bringing water into public ownership!

Right now in England our water is owned by private companies and the profits go to investors around the world, in countries as far away as Australia, Canada, Malaysia and Hong Kong. It doesn’t make sense! Water is a basic right and there’s no need to pretend we need ‘competition’. In any case, we don’t have a choice about where our water comes from.

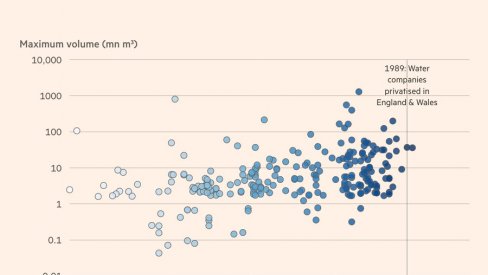

235 cities have taken water into public ownership in the last 15 years, many of them in France and the US. Water is already publicly owned in Scotland, while in Wales there is a not for profit water company. So how do we take control of our water in England?

Step 1: Compensate the shareholders

The UK parliament has the power to decide how much to compensate water company shareholders; what is a fair level of compensation. This decision about compensation should take account of the fact that the water companies have not contributed much since privatisation.

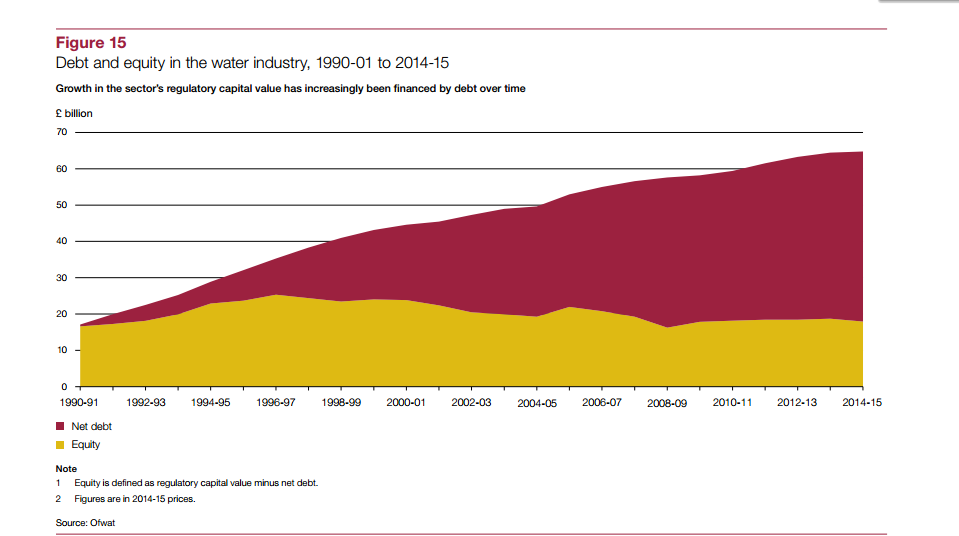

- They’ve increased debt from zero in 1989 to a mountain of £42 billion today and used debt to finance investment

- They've kept the overall level of shareholder investment about the same - in fact equity has dropped slightly (see the graph from the National Audit Office below)

- They've extracted profits of around 12% - £1.8 billion - year after year

- They pay the CEOs of the 19 water companies huge amounts - £10 million in 2012

- They've increased our bills by 40% in real terms

Bringing water into public ownership would save us £1.8 billion a year on shareholder dividends alone. If we compensated shareholders for £18 billion – which would be MORE than the £15 billion they’ve put in to the industry – this proposal would pay for itself in 10 years.

Step 2: Create regional public water companies

Create new regional public water companies. These would be accountable to us, the public. They would be owned and run through partnerships of local authorities with representatives from local communities and employees. Take the functions of the regulator, Ofwat, into a government agency, accountable to parliament and required to hold open monthly consultations.

Step 3: Enjoy water that works for people not profit!

After 10 years we could use the money we’ve saved to cut everyone’s water bills, invest in infrastructure or pay off some of that debt mountain the private sector has racked up. Then we can sit back and enjoy having water that belongs to all of us and accountable water companies that put people before profit!

Read our manifesto 'How public ownership can give us real control'.

And if you like this plan, please SHARE to spread the word!

Photo credit: Public Domain Photography

Comments

Phil Smith replied on Permalink

Thank GOD for Jeremy Corbyn. It's about time we actually had a politician to believe in who demonstrates he is for the people of this country and not in it for himself.

Anthony Sperryn replied on Permalink

Quite a lot of the capital investment in the water companies since privatisation will have been paid for by way of higher bills for customers, rather than by shareholders who, in principle, should have provided the money up front. Higher prices will have been allowed by OFWAT, the regulator, on the basis that the companies needed extra money to pay for investment.

In my opinion, the customers ought to have been compensated for their higher bills by receiving shares in the water companies. They would, of course, have had to pay for higher depreciation charges in their bills, but those charges would have been alleviated by the tax allowances available to the water companies.

In other words, the water company shareholders have had a free ride, not just from customers, but from UK taxpayers generally.

This is a sophisticated form of tax-dodging.

It will need someone more familiar with tax than me to work out what might be fair compensation for the shareholders of the water companies, but it might be possible to argue that their initial purchase price constituted a payment for an annuity which might already have run its course and that they, having had substanial dividends over the years, should not be paid anything to give up their shareholdings. Clearly, that would not be realistic, but refund of the original issue price for the shares might be feasible.

In any case, the high degree of leverage they introduced by way of borrowing from off-shore sources (interest, generally, being offsettable against UK profits) amounts to another form of dodging tax and depriving the UK Exchequer of revenue.

Globalisation is all very well, but needs global government to control. It's rather sad that we have seen the UK asset-stripped in recent years by way of simple-minded privatisations and the dogma that denies a role for governments to look after the public interest.

mark soffe replied on Permalink

why not have more than one company per area to choose to buy water from ? a coice could even be ''owned'' by the people of that area and with the profits buy shares in the other water companies ?

Charlotte Revely replied on Permalink

Because you can't realistically choose a supplier when there is only one lot of infrastructure and it doesn't make sense. The economies of scale come from having one lot of administration and a unified system. All the investment goes into improving that system. It also means you could generate behavioural change e.g. charging the low users a lower fee for basic needs water consumption and charging medium to high users a much higher rate to discourage excessive use. This would help with water poverty and help to manage a critical resource as we learn to deal with climate change etc.

Paatrick Newman replied on Permalink

No point - it is a natural monopoly like energy supply. Better to have a strong local consumers representative body with defined accountability.

Fran Cotton replied on Permalink

Compensation should be only on the basis of proven need.

Martin Hollands replied on Permalink

Step 1: Compensate the shareholders

The UK parliament has the power to decide how much to compensate water company shareholders; what is a fair level of compensation. This decision about compensation should take account of the fact that the water companies have not contributed much since privatisation.

Apart from the Billions they have and copntinue to invest you mean. Look at Thames Water's investments on both existing and capital schemes.

Besides compensation should go over and above the value per share. Don't mislead people here.

Andy Miles replied on Permalink

Privatisation of water and other utilities is just Tory ideological dogma in action, and has no rational basis in terms of supplying the needs of the people. The only legitimate purpose of any elected government is to serve and protect the people, but this Tory government shows utter contempt for the people, and serve only their wealthy patrons.

Water is not a commodity to be sold for profit, but a right, and a necessity for us all, which needs to be supplied as efficiently and cheaply as possible, while doing everything that needs to be done to conserve this precious resource. June the 8th is our great opportunity to get rid of the Tories, and set our nation in a new and progressive direction for the benefit of us all.

Anthony Sperryn replied on Permalink

Step 1. needs to be looked at very carefully.

I was shocked when Thames Water was seeking government guarantees for the new sewage system in London.

Seeing the comments here and on Facebook, it occurred to me that the water companies might be in breach of their statutary obligations under the legislation covering privatisation. The obligations could include keeping the infrastructure in good order. They could include having an audit statement that the company, not only presented accounts which gave a true and fair view, but also was a going concern. Auditors might, then, also find themselves vulnerable.

In the Thames Water case, a government giving a guarantee could reasonably expect a very heavy compensation for its involvement. At worst, the company's shares (and, possibly some of the associated debt) could be of zero value, or, even, the shareholders could be asked to pay back dividends received in the past.

Richard Wilson replied on Permalink

I work for our local water company and I have been saving shares each month since I was 16. This is my only savings I have. I fully support labour and am a labour voter. I am not a wealthy man but I would hate my only savings to be force purchased from me and have reduced savings after 21 years service.

Anthony Sperryn replied on Permalink

I fully understand your concerns, Richard Wilson. If you have been able to buy shares in your water company, your employer, you may be in a minority of water company employees and what you have been doing is admirable, if risky on the basis of having all your eggs in one basket.

There are various alternative models of public ownership and control of water (and other companies). What you, yourself, are in is a situation where there are employee shareholdings. Hopefully, employees contribute whole-heartedly to the business because they own it as individuals. In theory, you get the best of all worlds - people's capitalism, rather than Stalinist state control. In a mutually-owned business, there are similarities and employees may get profit-related bonuses, but ownership is collective. Building Societies are an example of mutuals, but the fate of many of them, recently, shows what can happen when they lose their vocation. Management and customer greed played a part, too.

Another situation could be where the state owns the business in its entirety and the customers may fight the state for lower prices, more investment, or whatever.

A third situation is where the ownership of the business is in the hands of a national pension fund and the profits of the business go to pay state pensions (and, possibly, other pensions by way of inflation-linked bonds). This puts the day-to-day management of the business at arms-length from the politicians who happen to be in power at any time, though some democratic control needs to be there and abuse needs to be prevented.

In each case, the crucial elements are the setting of the price (of water or whatever), and the amount of capital investment required - on the assumption that the people managing the business refrain from paying themselves excessive salaries. In what is really a monopoly situation (for water, at least), a regulator is needed, but there is always plenty of scope for misleading accounting to be put forward.

I am not in a position, nor legally entitled, to give you any investment advice, and investment is scary for all but the very rich. I have put down these thoughts so that readers may realise that there are wide issues involved.

Jan replied on Permalink

Just wondering whether compensation for shareholders would be necessary. The Government says competition is the best way to bring down prices, and various bodies outside the big six for fuel are now supplying the market. What would stop a government opening a state run company at prices so competitive, consumers would choose the state supplier? Ditto water.

Richard Tod replied on Permalink

Why pay shareholders anything? The companies have to bid for their contracts every 5 years. Just don't renew their contracts.

Add new comment