19 December 2024

Ofwat has just announced that your water bills will rise by 36% over the next five years.

Here are the top five reasons why this should not be allowed:

1) Privatisation means you're paying more for less.

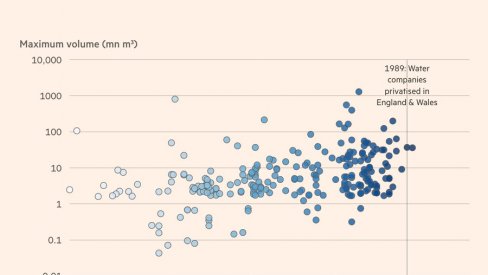

You will be paying almost DOUBLE for your water bills compared to before privatisation. Privatisation was supposed to reduce your bills, it's done the opposite. Only 65% of the price rise will be used for investment. Your private water company will take more than one third of your bill to pay interest on debt and dividends to shareholders.

2) All the investment in water infrastructure has come from your bills, with an added privatisation tax on top - that's the money you spend that goes into paying for dividends and debt.

Shareholders have invested less than nothing in the 35 years since privatisation. They have extracted £83 billion while building up a debt mountain of nearly £70 billion, and allowing raw sewage to pour into rivers and seas. Read more in this report from the Public Services International Research Unit.

3) The government is refusing to look at the possibility of public ownership because they say it would cost "£100 billion". This is untrue. It is based on an "economically illiterate" report funded by the private water industry - read more.

"Arguing that the country is worse off because it buys assets, with a significant yield to finance the accompanied assets, is simply wrong." Dieter Helm, Professor of Economic Policy at the University of Oxford

In any case, Moody's has estimated that the cost of buying back the water companies would be around £14.5 billion.

4) The government could make private water companies operate within the law and withdraw their licences if they do not. It could withdraw Thames Water's licence right now because the company is financially insolvent.

The Treasury has said that using these 'Special Administration' powers would mean Thames Water's debt would be cut by 40%, while JP Morgan has estimated creditors would take a 'haircut' of 55%. The remaining debt could be refinanced more cheaply in public ownership.

In other words, privatised Thames Water is only surviving because the government is letting YOU prop it up with your bills (if you're a Thames Water customer you'll pay an extra £250 a year for the planned bailout). Steve Reed the Environment Secretary could take it back as it is going bust.

All of the privatised English water companies could be required to stop illegal sewage dumping. This will make them less profitable, then they will be cheaper to get back, because their inflated 'value' is simply based on how much they expect to be able to rip off the public into the future. If they complain that they are 'uninvestable' that is the time to take them back, either because they are going bust or because they are not fulfilling their statutory duties to protect the environment.

5) 82% of us want water in public ownership. This is normal in 90% of the world, including in Scotland and France.

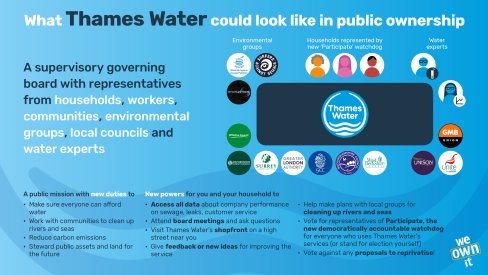

Public ownership doesn't fix all problems automatically, we also need good governance (see our model for what Thames Water could look like) and a focus on cleaning up rivers and seas. But without public ownership, we'll continue pouring all of our rising water bills directly into a handful of private pockets.

Why should we pay a penny more to prop up the disaster that is privatisation?

Take action: email your MP today.

Comments

Steve replied on Permalink

I totally agree with this.

We need a referendum on what the people want versus what the government and that moron Steve Reid think is best, which is too sore then to carry on as they are!

Add new comment