24 November 2017

Water companies are on the defensive in the media. There's been a flurry of 'good news' water company stories in the last few weeks, and we don't think it's a coincidence.

They’re afraid that we’ve spotted the many times they’ve failed. They’re well aware that 83% of us want to bring them into public ownership.

Water companies have increased our bills by 40% in real terms. They’ve financed investment through a debt mountain while taking out billions in profit. Time and again, they’ve released raw sewage into rivers, then just absorbed the fines that come their way.

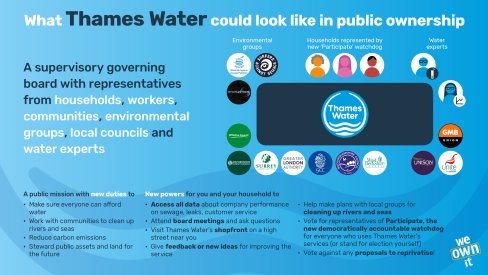

Privatised water is a real scandal. We need to buy back the water companies and turn them into accountable, regional public organisations that work for all of us.

But these companies want to stay privatised - so they’re trying to show us that they do care about their public image. Which is your favourite story?

1) Severn Trent – helping our housing crisis?!

Severn Trent has ‘pledged to help Britain’s housing crisis by selling its surplus land to developers’! Apparently, it will use the money it raises from the sales to keep bills low!

Our thoughts:

- If Severn Trent is really just trying to help with the housing crisis, it could give away land instead of selling it.

- If Severn Trent wants to reduce bills, it could use its hefty profits to do so.

- Severn Trent, like all private water companies, doesn’t have a strong track record of caring about the public.

- Maybe Severn Trent is trying to make money quickly before it’s brought into public ownership?

- What is this surplus land? Perhaps it might be useful to the public? Please return it to us instead of selling it off to private developers. Quite possibly it used to belong to us in the first place. We could build council homes if the land really is surplus.

2) Thames Water and Yorkshire Water – tax dodging no more

According to the Financial Times…

Yorkshire Water is closing its Cayman Islands subsidiaries, although the company says these are not used to evade tax.

“There is a real challenge to the water industry’s legitimacy at the moment,” said Liz Barber, Yorkshire Water’s group director of finance, regulation and markets.

Thames Water is also closing its subsidiaries in the Cayman Islands. The company has hired Ian Marchant, former boss of power company SSE. He’ll be paid £325,000 a year for working two days a week!

Marchant will be assessing the company’s “corporate structure and governance to ensure that it is as simple and transparent as possible for its customers and stakeholders”.

The company has paid no corporation tax at all for the last 10 years, says the FT – but now, maybe it will! It's about time.

3) South West Water – is NOT using magic to find leaks

It has emerged that many water companies are using divining rods to find water, despite there being no scientific evidence that this works. But South West Water has “done a U-bend” – it is NOT using the ancient practice of dowsing to find leaks!

This story is a nice distraction from the damning research recently released by Corporate Watch about South West Water. It found that the company pays out more to owners and financiers than it invests in water and sewage services.

“If any company justifies an end to privatisation it is South West Water. Could Devon and Cornwall show the rest of the country the way?” Corporate Watch

According to the Environment Agency, the company’s spills have caused pollution to rivers, fish kills, damage to ecosystems and pollution on beaches.

But don’t worry, it's not using magic!

Which of these three is YOUR favourite story? Do any of them make you think twice about the need to bring water into public ownership?

The directors and PR departments of these water companies are only doing their jobs. But maybe they could start thinking about what their companies would look like if they were publicly owned and accountable. They could focus on providing a great service, with no need to defend the indefensible.

Investec analysts (in the Telegraph): “With the Labour Party gaining momentum, the threat of nationalisation is no longer academic...While it is tempting to write off renationalisation as the brainchild of Jeremy Corbyn, there is mounting evidence that the proposal is popular amongst the voting public, specifically regarding the water sector."

Damn right.

The proposal is very popular with the voting public. Bring it on.

Comments

John Hall replied on Permalink

- Seems like all privatised utilities are profiteering at customers' expense. Take wonderful Anglian Water, (once run by Johnson Cox, current head of watchdog, Ofwat). From 2003 to 2017, Anglian paid out about £5,000m in dividends - far more than justified by the amount of equity held in the utilitiy.. Share owners put up just over one per cent of investment funds of over £7,500m (during this time), which mostly came from charges to customers plus about one third borrowed. (Former publicly-owned utilities could borrow too!) Anglian has lined-up possibly another £2,000m to £3,000m of value to strip from the utility which will be quite posible if regulation continues as it has done since privatisation. It is not just the water utilities and their parent companies that are at fault. Regulation has a lot to answer for!

Mike replied on Permalink

The privatised water companies have had 'decades' to sort out the problems of water supply... mainly the massive loss of water through leaky reticulation... But no, too intent on ripping out profits and dividends for shareholders... The water supply monopoly must come to an end.. time to 'NATIONALISE.' With no compensation or payout for shareholders.

Add new comment