Fully owned by YTL, a Malaysian corporation listed on the stock exchange there and half owned by the family of the billionaire who set it up.

Water in England and Wales was privatised in 1989. The government sold off ten previously public regional monopolies. In Scotland they have publicly owned Scottish Water. Welsh Water is now a not-for-profit.

The private English water companies are at least 70% owned by foreign shareholders.

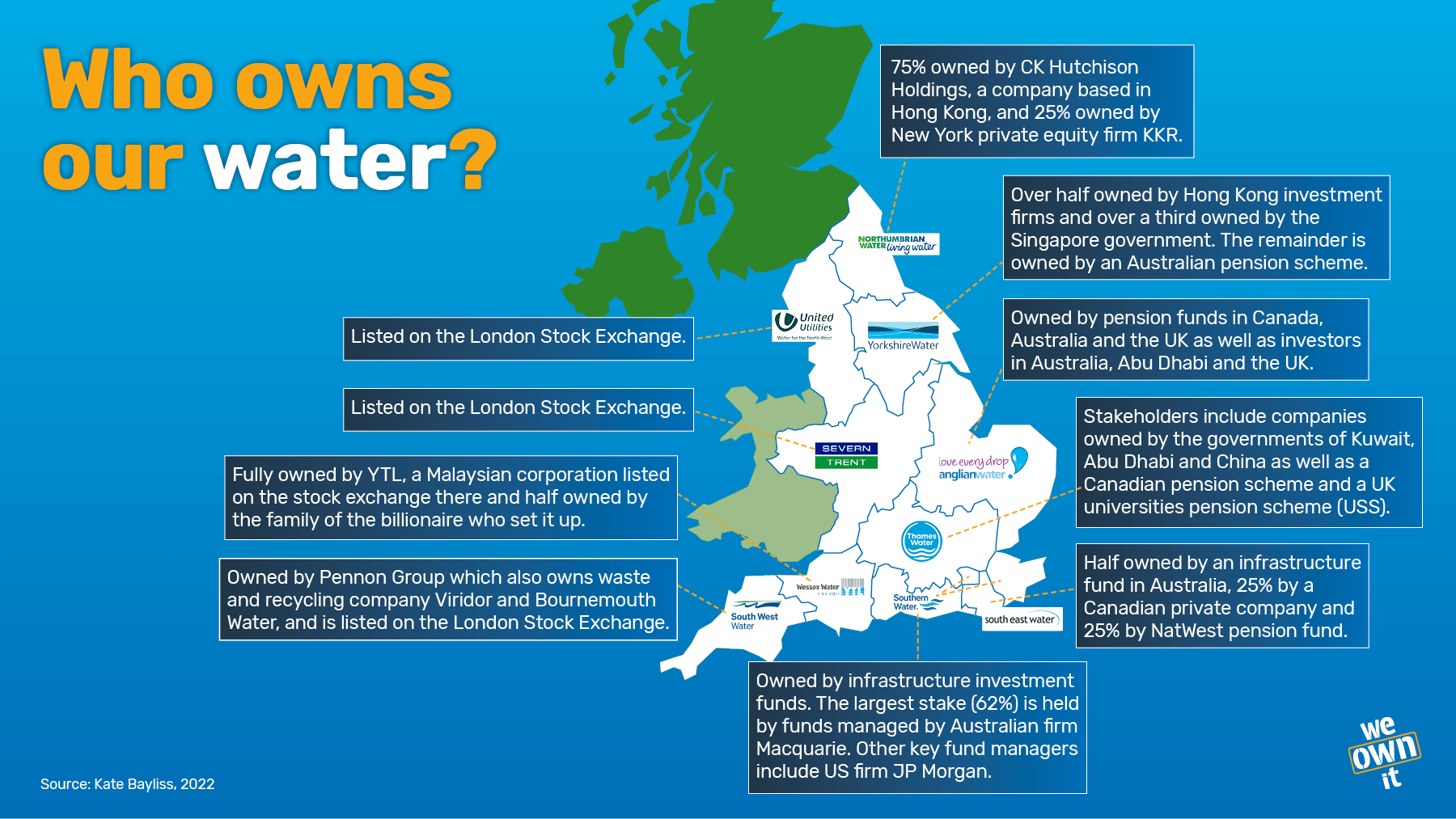

Anglian Water: Owned by pension funds in Canada, Australia and the UK as well as investors in Australia, Abu Dhabi and the UK.

Northumbrian Water: 75% owned by CK Hutchison Holdings, a company based in Hong Kong, and 25% owned by New York private equity firm KKR.

Severn Trent Water: Listed on the London Stock Exchange.

South East Water: Half owned by an infrastructure fund in Australia, 25% by a Canadian private company and 25% by NatWest pension fund.

Southern Water: Owned by infrastructure investment funds. The largest stake (62%) is held by funds managed by Australian firm Macquarie. Other key fund managers include US firm JP Morgan.

South West Water: Owned by Pennon Group which also owns waste and recycling company Viridor and Bournemouth Water, and is listed on the London Stock Exchange.

Thames Water: Stakeholders include companies owned by the governments of Kuwait, Abu Dhabi and China as well as a Canadian pension scheme and a UK universities pension scheme (USS).

United Utilities: Listed on the London Stock Exchange.

Wessex Water: Fully owned by YTL, a Malaysian corporation listed on the stock exchange there and half owned by the family of the billionaire who set it up.

Yorkshire Water: Over half owned by Hong Kong investment firms and over a third owned by the Singapore government. The remainder is owned by an Australian pension scheme.

Source: Table 1. Owners of water and sewerage companies in England (November 2021) published in ‘Private equity and the regulation of financialised infrastructure: the case of Macquarie in Britain's water and energy networks’ Kate Bayliss, Elisa Van Waeyenberge, Benjamin O. L. Bowles, New Political Economy Volume 28, 2023

Read about how we can bring water into public ownership here.

Read more about the privatised English water companies below.

Fully owned by YTL, a Malaysian corporation listed on the stock exchange there and half owned by the family of the billionaire who set it up.

Over half owned by Hong Kong investment firms and over a third owned by the Singapore government. The remainder is owned by an Australian pension scheme.

Owned by pension funds in Canada, Australia and the UK as well as investors in Australia, Abu Dhabi and the UK.

Stakeholders include companies owned by the governments of Kuwait, Abu Dhabi and China as well as a Canadian pension scheme and a UK universities pension scheme (USS).

75% owned by CK Hutchison Holdings, a company based in Hong Kong, and 25% owned by New York private equity firm KKR.

Owned by infrastructure investment funds that are 62% managed by Australian firm Macquarie, other key fund managers include US firm JP Morgan.

Owned by Pennon Group which also owns waste and recycling company Viridor and Bournemouth Water, and is listed on the London Stock Exchange.

Half owned by an infrastructure fund in Australia, 25% by a Canadian private company and 25% by NatWest pension fund.